Unveiling the Mysteries of Vastu Shastra: Harmonizing Your Living Spaces

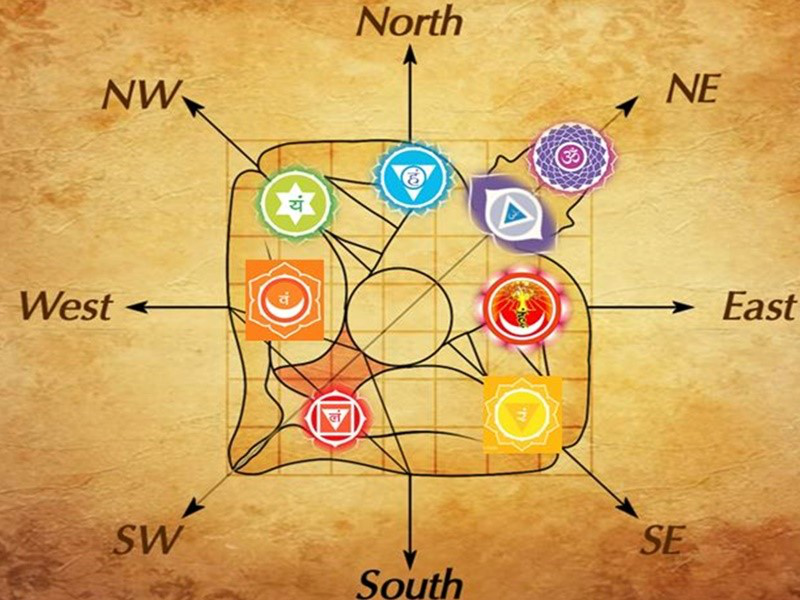

Vastu Shastra, an ancient Indian science, provides a profound understanding of how the energy in our surroundings impacts our well-being. This blog aims to delve into the principles of Vastu Shastra, exploring ways to create harmonious and balanced living spaces that promote positive energy flow.

Incorporating Vastu Shastra principles into your living and working spaces can have a profound impact on your overall well-being. By understanding and applying these ancient principles, you can create an environment that fosters positivity, balance, and harmony. Remember, the key lies in a thoughtful and respectful approach to the energy that surrounds us.

DEHRADUN AS A REAL ESTATE

Discover the enchanting real estate landscape of Dehradun through our informative blog. From the bustling neighborhoods of Rajpur Road to the serene charm of Dalanwala, we delve into the diverse tapestry of this Himalayan city. Stay abreast of the latest market trends, property listings, and investment opportunities that define the real estate dynamics in Dehradun. Our blog goes beyond property listings, offering valuable insights into the community, lifestyle, and upcoming developments that shape the city’s real estate scene. Whether you’re a prospective buyer, seller, or investor, our expert tips, neighborhood spotlights, and in-depth guides provide the essential information you need to navigate the Dehradun real estate market with confidence. Join us in exploring the fusion of tradition and modernity in Dehradun’s real estate realm, where each property tells a unique story against the backdrop of the picturesque Himalayan foothills.

LOAN PROCESS

The real estate loan process involves several key steps. It begins with the borrower seeking pre-approval from a lender by submitting financial documents. Once pre-approved, the borrower selects a property and formally applies for the loan, providing detailed information about personal finances and the chosen property. The lender’s underwriting team reviews the application, assesses creditworthiness, and approves the loan based on the property’s value and borrower’s qualifications. A title search, home inspection, and final approval follow. The closing involves signing documents, transferring ownership, and paying closing costs. Post-closing, the lender records the mortgage, and the borrower begins making regular payments. It’s essential to work with a real estate agent and a knowledgeable lender to navigate this process efficiently.